Apply Alaska Airlines Visa Signature Card – Max Your Mileage Plan Travel Rewards

The Alaska Airlines Visa Signature card, issued by Bank of America, is a best-in-class travel rewards credit card tailored to frequent flyers of Alaska Airlines and its global partners. This premium Signature card stands out due to its high-value welcome bonus, annual companion fare, free checked baggage, and ongoing miles-earning capabilities across everyday categories.

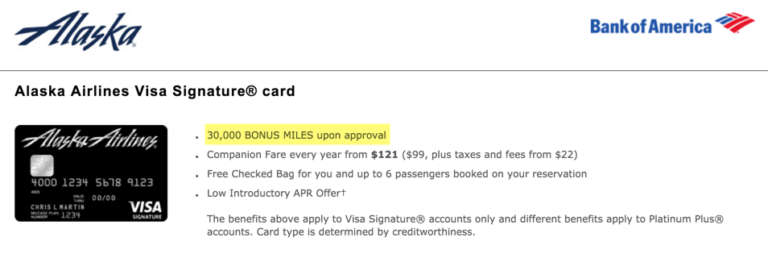

Welcome Bonus and Sign-Up Offer

When you apply and are approved, the card offers a compelling new user bonus:

- 70,000+ Alaska Mileage Plan miles after spending $3,000 in the first 90 days.

- Annual Companion Fare certificate after you spend $6,000 each account year—redeemable for $99 (plus taxes) companion tickets on Alaska flights.

These benefits often generate travel value worth well over $1,000—particularly if you plan to fly with a companion on longer or coast-to-coast trips.

Ongoing Earnings & Everyday Bonus Categories

With this card, you earn:

- 3× miles per dollar on Alaska Airlines purchases

- 2× miles on gas, electric vehicle charging, transit, ride-share, cable, and streaming

- 1× mile on all other purchases

Additionally, if you pair it with a Bank of America checking or savings account, you may receive an extra 10% annual mileage bonus on miles earned—maximizing your total mileage accrual.

Card Benefits That Offset the Annual Fee

The $95 annual fee is justified through substantial perks:

- Free first checked bag for cardholder and up to six guests on Alaska flights—saves ~$70 roundtrip.

- Priority boarding for you and companions ensures better cabin access and overhead bin space.

- 20% inflight discount on meals, cocktails, lounge passes, and Wi-Fi purchases.

- $100 discount on Alaska Lounge membership when fee is charged to the card.

- No foreign transaction fees, making it ideal for international travel.

Combined, these benefits often outweigh the annual cost for anyone who flies with Alaska even a few times per year.

Real-World Product Examples

Product 1 – Alaska Airlines Visa Signature (Personal)

The Alaska Airlines Visa Signature (Personal) card is perfect for regular travelers. Its high welcome bonus, generous bonus categories, and Companion Fare make it ideal for couples and families traveling domestically or internationally with Alaska Airlines partners.

Use case: Jane flies from Seattle to Honolulu often. The free checked bag, companion fare, and inflight discount help her save more than $300 annually.

Where to apply: Apply Now – Alaska Airlines Visa Signature (Personal)

Product 2 – Alaska Airlines Visa Business

The Alaska Airlines Visa Business card mirrors the personal version but tailored to small business owners. With the same bonus earning structure, it also helps you use business expenses to fast-track mileage, EQMs, and companion passes.

Use case: A small consultancy uses this card for all flights, car rentals, and business subscriptions—earning 2× miles on streaming and more, including the $99 companion certificate.

Where to apply: Apply Now – Alaska Airlines Visa Business

Product 3 – Bilt World Elite Mastercard

Although not an Alaska Visa, the Bilt World Elite Mastercard complements Mileage Plan travel. You can earn 3× points on rent without fees, transferring to partners that align with Alaska redemption strategies.

Use case: Rafael pays his rent through Bilt and transfers points to Alaska for premium cabin award bookings on partner airlines.

Where to apply: Apply Now – Bilt World Elite Mastercard

Combining both cards opens up advanced mileage maximization.

Product 4 – Bank of America Premium Rewards Credit Card

Pairing the Alaska Visa with the BofA Premium Rewards card gives you broader global coverage. This card gives 2× points on travel/dining and a $200 travel credit—ideal for non-Alaska travel needs.

Use case: Anna flies Alaska for domestic legs but uses this card for flights on other airlines, hotels, and travel insurance.

Where to apply: Apply Now – BofA Premium Rewards Card

Product 5 – American Express Gold Card

The Amex Gold Card provides 4× points on dining and groceries, which can transfer to airlines with more value. Use it alongside Alaska Visa to cover diverse spending and transferable points.

Use case: Michael uses Amex Gold for food and groceries, then transfers points to travel partners and periodically redeems via Alaska’s Mileage Plan partner flights.

Where to apply: Apply Now – American Express Gold Card

Practical Usage Scenarios & Problem Solutions

(Indonesian: jelaskan bagaimana kartu ini menyelesaikan masalah nyata pengguna)

- Problem: Frequent traveler pays high baggage fees.

Solution: Free checked bag saves $70–140 per roundtrip journey, making this card hassle-free. - Problem: You travel with a partner but find roundtrip tickets expensive.

Solution: Companion Fare certificate allows two tickets for the cost of one + $99, saving $300–600. - Problem: Want elite status fast.

Solution: Earn elite qualifying miles (EQMs) through everyday spending and bonus categories without flying.

How to Apply & Best Places to Buy

(Indonesian: panduan praktis apply dengan tautan dan button affiliate-style)

- Choose the right card (Personal or Business).

- Use the official Alaska Airlines or Bank of America site via affiliate/blogger links for best promotional offers.

- Provide accurate personal data matching your Mileage Plan account to avoid declines.

- Meet spend requirement within 90 days to earn bonus miles.

- Consider pairings with Bilt, Amex Gold, or BofA Premium for strategic points diversification.

FAQ

1. How long does the Miles bonus post after approval?

Miles are typically posted within 2 billing cycles after meeting the spending requirement, depending on your statement cycle.

2. Can I earn elite status EQMs using only credit card spend?

Yes. Alaska typically awards elite miles based on spend thresholds alongside flown segments—card spend contributes substantially toward Silver, Gold, or MVP Gold status.

3. Is the Companion Fare limited to Alaska Airlines flights only?

Yes. The Companion Fare applies to Alaska Airlines-operated flights, including mainline and Horizon Air flights. Not valid on partner airline itineraries.