Best Alaska Airlines Credit Card Types: Comprehensive Guide to Maximize Miles & Perks

Alaska Airlines offers several co-branded Visa® credit cards designed to help frequent flyers earn miles, take advantage of companion fares, and streamline travel. This guide delves into the top transactional keyword: “Alaska Airlines credit card types” by analyzing the Personal Signature Card, Business Card, and upcoming Premium Card, and comparing them with alternative travel rewards options. Each section covers features, benefits, real-life use cases, and application guidance.

Overview of Alaska Airlines Credit Card Types

Alaska Airlines currently offers three core Visa credit card tiers, all issued by Bank of America:

- Personal Alaska Airlines Visa Signature®

- Alaska Airlines Visa® Business

- Future Premium Alaska Airlines Visa (early-access launch)

These cards allow users to earn Mileage Plan™ miles, enjoy free checked bags, receive priority boarding, and redeem annual companion fares. All feature no foreign transaction fees, making them ideal for international travel (alaskaair.com, thepointsguy.com, upgradedpoints.com).

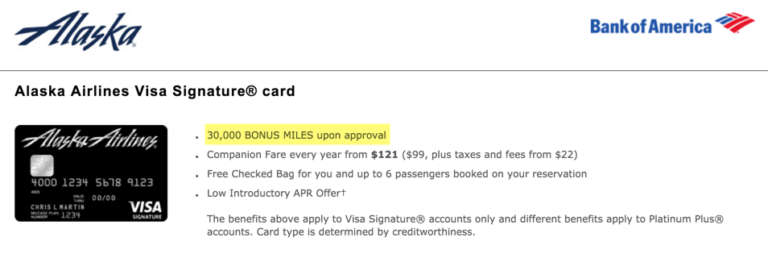

Personal Alaska Airlines Visa Signature® Card

Features and Benefits

This card earns 3 miles per dollar on Alaska Airlines purchases, 2 miles per dollar on gas, EV charging, transit, cable, and streaming, plus 1 mile per dollar elsewhere (thepointsguy.com). Annual perks include:

- Annual Companion Fare after $6,000 spend

- Free checked bag for the cardholder and up to six companions

- 20% back on in-flight purchases

- Priority boarding

- Discounted Alaska Lounge+ membership

Use Cases and Benefits

Travelers heading to Alaska or the West Coast can benefit from Alaska’s broad route map. A family flying once a year can offset the $95 annual fee via the companion fare alone. Also, in-flight Wi-Fi and food purchases are effectively discounted with the 20% credit.

Why You Need It

If your travel revolves around Alaska Airlines or its Oneworld partners, miles earned (valued at 1.5¢–1.6¢ each) quickly pay off. Free baggage and priority boarding enhance convenience and customer experience (frequentmiler.com, thepointsguy.com, thepointsguy.com).

How to Apply

Apply for the Alaska Airlines Personal Signature Card

Keterangan: Tombol CTA bergaya affiliate untuk pendaftaran.

Alaska Airlines Visa Business Card

Features and Benefits

The business version offers the same core perks—3× miles on Alaska purchases, 2× on eligible business expenses (e.g., shipping, gas), and annual companion fares—plus:

- Ability to issue multiple cards per business

- Same free baggage, boarding, and lounge discounts

- Annual fee: effectively $95 (company pays $70, each card $25) (thepointsguy.com)

Use Cases and Benefits

For small business owners, this card helps separate expenses while earning miles. A travel team managing multiple employees flying Alaska can easily handle reimbursements and boarding perks without extra cost.

Why You Need It

Business-related spending (fuel, shipping) accumulates miles quickly. Plus, employees traveling together enjoy baggage and boarding benefits automatically applied to their reservations.

How to Apply

Apply for Alaska Airlines Business Card

Keterangan: Tombol CTA bergaya affiliate untuk pendaftaran.

Premium Alaska Airlines Visa (Coming Soon)

Features and Benefits

Alaska Airlines is introducing a new Premium Visa, likely with a higher annual fee but enhanced rewards like:

- Elevated miles per dollar on Alaska and partners

- Additional travel credits or lounge access

- Anniversary Companion Fare with more flexible redemption

Early registrants can earn 500 bonus miles before year-end (thepointsguy.com, frequentmiler.com, bankofamerica.com).

Use Cases and Benefits

Frequent travelers, especially those flying premium or long-haul routes, may offset the higher fee via premium perks. Additional miles-earning and travel credits make it valuable for business travel and loyalty seekers.

Why You Might Want It

If you have already maximized the current Signature or Business cards, the Premium tier may give that extra value through exclusive benefits and faster elite qualification.

How to Pre-Register

Pre-Register for Premium Card

Keterangan: Tombol CTA affiliate untuk early access.

Alternative Travel Credit Cards

In some cases, general travel rewards cards offer stronger value. Top contenders include:

The Platinum Card® from American Express

- 5× points on airline and prepaid hotels

- Global lounge access and up to $200 airline incidental credits

- Transferable Membership Rewards points, including to Alaska Airlines (alaskaair.com, thepointsguy.com, upgradedpoints.com)

Chase Sapphire Reserve®

- 3× points on travel/dining, $300 annual travel credit

- Excellent travel protections and lounge access via Priority Pass (thepointsguy.com, nypost.com)

These are ideal if you fly on multiple airlines or want top-tier travel perks.

Choosing the Right Credit Card

Frequent Alaska Flyers

Use the Signature or Business Alaska cards to capture companion fares and fare-based benefits.

Business Owners with Travel Teams

Go for the Business Card, which allows multiple employees to benefit from the same perks.

High-Spend or Elite Travelers

Watch for the Premium Card; if it offers lounge perks or elevated rewards, it may outperform the basic versions.

Multi-Airline Travelers

A general travel rewards card adds value if your flights frequently include non‑Alaska Airlines carriers.

Mileage Plan Elite Qualification

Alaska Airlines awards 1 Elite Qualifying Mile per $3 spent on either a co-branded Signature or Business card, up to 30,000 EQMs per year (frequentmiler.com, thepointsguy.com). This can fast-track status, such as MVP or MVP Gold, when combined with flown miles.

3 Real-World Use Cases

1. Family Trip to Hawaii

A family of four uses the companion fare to pay just $122 instead of full fares. Free bags and boarding make travel seamless and cheaper.

2. Small Business Conference

A business purchases three cards for traveling staff. They earn miles on shipping expenses and enjoy baggage and boarding benefits for meetings nationwide.

3. Aspiring Elite Traveler

A frequent business flyer uses $90k in card spend to boost EQMs while using Premier rewards card coverage and lounge access—ideal for both professional status and comfort.

How and Where to Apply

- Visit Alaska Airlines’ Mileage Plan credit card page.

- Choose your card (Personal, Business, or register early for Premium). Apply online—approval is often instant.

- Receive the card and activate it.

- Start using it on eligible purchases, flights, and travel services.

- Redeem companion fare and travel perks via your Mileage Plan account.

Frequently Asked Questions (FAQ)

1. Which Alaska Airlines credit card is best for international travel?

The Premium card (when released) may offer higher miles and travel credits. Meanwhile, the Signature card, with no foreign transaction fees, is a solid choice for global travelers.

2. Can I hold both the Personal and Business cards?

Yes, they are separate products. Many small business owners own both and maximize companion fares and EQM earnings.

3. What happens to my miles if I cancel the card?

Miles earned through purchases stay in your Mileage Plan account even after card cancellation, as long as the account remains open.

By evaluating your travel habits, spending patterns, and loyalty goals, you can choose the Alaska Airlines credit card that offers the best return on investment. Whether you’re securing companion fares, building elite status, or earning flexible travel perks, Alaska’s co-branded and upcoming Premium offerings deliver strong value for frequent flyers.